CT Newsroom

Chief Justice of Pakistan (CJP) Yahya Afridi on Thursday outlined a plan to establish special courts focused on taxes and revenue cases.

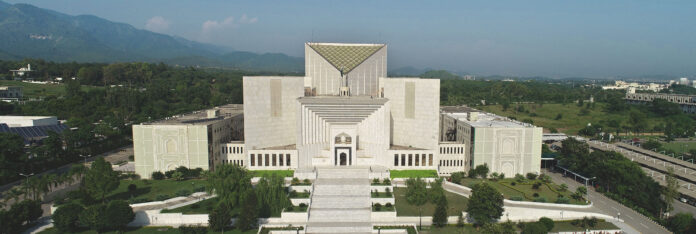

As per details, CJP Yahya Afridi formed a committee comprising judges and experts and held a series of meetings with them. It was decided in these meetings to clear over 59,435 cases lying pending before the Supreme Court of Pakistan. The CJP also set an example by deciding to establish special courts specifically for resolving over 3,000 cases related to taxation and revenue.

According to a press release, the CJP ordered the committees to develop a diagnostic study to design strategies for short and medium-term plans to clear pending cases.

It was also decided in the meetings that the proposed plan of action would be open to public debate and feedback before implementation. Professionals from various fields will evaluate the existing resources, the efficiency and processes of prevailing courts, and other challenges before finalizing a “workable reform plan with timelines and an impact assessment mechanism.”

The CJP highlighted that the objective of this proposed involvement is to reduce the backlog of cases, improve accessibility, enhance transparency, generalize processes, incorporate technology, and promote a public-centric approach within the existing legal framework.

Yahya Afridi also expressed concerns over the 3,497 pending tax and revenue cases, amounting to a recovery worth Rs97 billion. He emphasized the need for more realistic, swift actions through Alternative Dispute Resolution (ADR) mechanisms. He urged top judges and encouraged lawyers to play an active role in clearing the backlog of fiscal cases.

The committee formed by the CJP will also assess current practices of the Federal Board of Revenue (FBR), assist in designing integrated global strategies, adopt ADR methods, and enhance FBR’s legal capabilities for efficient tax case resolution.

It is worth mentioning here that the CJP’s committee includes SC Registrar Muhammad Salim Khan, tax experts Asim Zulfiqar Ali and Imtiaz Ahmed Khan, Attorney General Mansoor Usman Awan, tax expert Sher Shah Khan, and a senior FBR official.